Esg funds: unlocking sustainable investment opportunities

ESG investing focuses on environmental, social, and governance factors, allowing investors to align their portfolios with ethical values while potentially achieving better long-term financial returns and promoting sustainability.

Esg funds have gained popularity as investors increasingly seek sustainable and ethical investment options. If you’re curious about how these funds can impact both your portfolio and the world, read on to discover essential insights and tips.

what are esg funds and why they matter

ESG funds are investment vehicles that prioritize environmental, social, and governance factors, allowing investors to align their portfolios with their values. You might be wondering, why do these funds matter? The answer lies in the shifting landscape of responsible investing.

Understanding ESG Criteria

ESG criteria evaluate companies based on their impact on the environment, their relationships with stakeholders, and their governance structures. Investors increasingly use these metrics to identify firms that are sustainable and ethical, not just financially sound.

The Importance of ESG Funds

Investing in ESG funds means supporting companies that focus on long-term sustainability. Such investments not only drive positive change in society and the planet but also have the potential for better returns. Research shows that firms with strong ESG profiles often outperform their peers in the long run.

How to Start Investing in ESG Funds

To begin investing in ESG funds, assess your values and financial goals. Look for funds that have a proven track record of sustainability. Many financial advisors now offer expertise in ESG investing, helping you make informed choices that reflect your ethical stance.

benefits of investing in esg funds

Investing in ESG funds brings numerous advantages that appeal to conscientious investors. These funds not only help in building a sustainable future but also offer potential financial rewards. Curious about the specific benefits? Let’s explore.

Positive Environmental Impact

One of the primary benefits of ESG funds is their focus on companies that prioritize environmental sustainability. By investing in these funds, you’re contributing to initiatives that combat climate change, reduce waste, and promote cleaner energy sources. This not only benefits the planet but can lead to more stable investments.

Social Responsibility

ESG funds invest in companies that value social responsibility, including fair labor practices, community engagement, and diversity. Supporting these values can lead to a more just society while also appealing to consumers who prefer ethically sound brands. Investing in socially responsible companies can enhance brand loyalty and customer satisfaction.

Long-term Financial Benefits

Research shows that companies with strong ESG practices tend to outperform their peers financially over time. These businesses are often more resilient to market fluctuations and regulatory changes. By investing in ESG funds, you’re positioning yourself for potential long-term financial growth while supporting positive change.

Access to a Growing Market

The popularity of ESG investing is on the rise, attracting more investors every year. This growing market trend creates opportunities for enhanced returns as companies focus on sustainability. By investing early in ESG funds, you can benefit from the momentum of this expanding sector.

how to choose the right esg fund

Choosing the right ESG fund can be a rewarding experience, but it also requires careful consideration. With many options available, knowing what to look for is crucial. Are you ready to make informed choices for ethical investing?

Define Your Investment Goals

Before diving into potential funds, take a moment to clarify your investment objectives. Are you looking for long-term growth, income, or a balance of both? Understanding your financial goals will help you select a fund that aligns with your aspirations.

Research ESG Ratings

Explore the ESG ratings of various funds. These ratings evaluate the fund’s commitment to environmental, social, and governance criteria. Look for funds that consistently score high in these categories, which often indicates responsible and sustainable practices.

Diversification and Asset Allocation

When selecting an ESG fund, consider the diversification of its holdings. A well-diversified fund spreads risk across different sectors and industries, enhancing potential stability. Additionally, pay attention to how the fund allocates assets between various ESG criteria to ensure a balanced approach.

Examine Fees and Expenses

Fees can significantly impact your investment returns over time. Look for ESG funds with reasonable management fees and lower expense ratios. Understanding these costs will help you assess the fund’s overall value and effectiveness as an investment vehicle.

Consult a Financial Advisor

If you’re unsure where to start, consider consulting a financial advisor who specializes in ESG investing. They can provide personalized guidance, helping you navigate your choices and align your investments with your values. It’s a small step that can make a big difference.

the impact of esg funds on the environment

The impact of ESG funds on the environment is profound and increasingly essential in today’s world. These funds channel investments into companies that actively promote sustainability and eco-friendly practices. But how exactly do these investments make a difference?

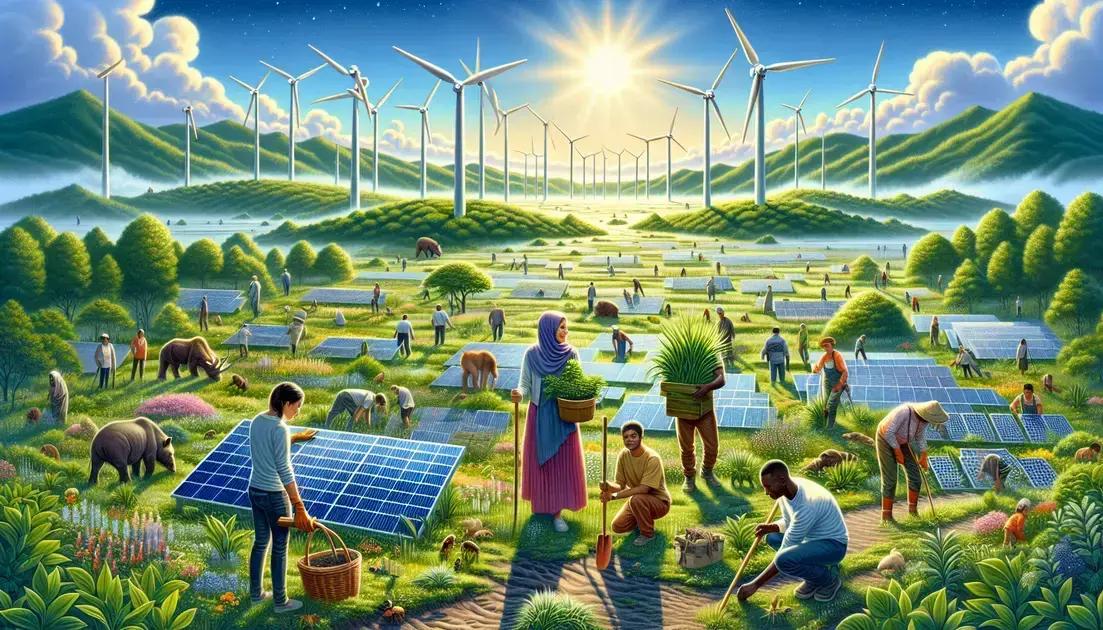

Supporting Renewable Energy

One of the key benefits of ESG funds is their focus on supporting renewable energy initiatives. By investing in companies that prioritize solar, wind, and other renewable sources, these funds help reduce reliance on fossil fuels, contributing to a cleaner environment.

Encouraging Sustainable Practices

ESG funds often back businesses that adopt sustainable practices. This includes reducing waste, implementing recycling programs, and minimizing carbon footprints. By supporting such companies, investors are playing a vital role in fostering a culture of sustainability that can lead to significant environmental benefits.

Impact on Biodiversity

Investing in ESG funds can also benefit biodiversity. These funds encourage practices that protect ecosystems and wildlife. Companies that prioritize sustainability work to limit their impact on natural habitats, promoting the preservation of diverse species and natural resources.

Long-term Environmental Change

The influence of ESG funds extends beyond immediate benefits. By promoting long-term sustainability, they can help mitigate climate change. As more investors choose ESG options, companies are incentivized to adopt green technologies and innovative solutions that foster a healthier planet for future generations.

challenges and criticisms of esg investing

While ESG investing offers many benefits, it is not without its challenges and criticisms. Understanding these issues is vital for investors looking to navigate this evolving landscape. What are the key concerns around ESG investing?

Lack of Standardization

One of the biggest challenges in ESG investing is the lack of standardized metrics. Different funds may use varying criteria to evaluate companies, leading to inconsistent ratings. This inconsistency can make it difficult for investors to compare funds or understand what they are truly investing in.

Greenwashing Concerns

Greenwashing is another significant issue. Some companies may misrepresent their ESG practices to attract investment while not genuinely adhering to sustainable or ethical standards. This practice can deceive investors and undermine the integrity of the ESG market.

Performance Debates

There is an ongoing debate about the financial performance of ESG investments compared to traditional investments. Critics argue that prioritizing ethical factors may compromise returns, although many studies suggest that responsible companies can outperform their less ethical counterparts over time.

Limited Investment Universe

Investing in ESG funds often limits the available investment universe. Some sectors, such as fossil fuels or tobacco, are typically excluded, which can restrict diversification. This lack of options can lead to higher volatility in an investor’s portfolio.

Complex Regulations

The regulatory landscape surrounding ESG investing is still developing, leading to confusion and compliance challenges for fund managers. As regulations evolve, firms must adapt, which can create operational hurdles and uncertainties in fund management.

future trends in esg investment landscape

The future trends in ESG investment are shaping the financial landscape as more investors prioritize environmental, social, and governance considerations. What should you expect in the coming years?

Growing Demand for Transparency

As ESG investing continues to evolve, there will be an increasing demand for transparency from companies. Investors want to know the details behind ESG claims, prompting firms to provide clearer metrics and reporting. This push for greater transparency will help build trust and accountability.

Integration of Technology

Technology is set to play a significant role in the future of ESG investing. Innovations like artificial intelligence and big data analytics will enhance the ability to assess companies’ ESG performance. This integration will improve decision-making processes and provide deeper insights into the sustainability of investments.

Impact Investing Growth

Impact investing, where profits are generated alongside positive social and environmental outcomes, will likely gain momentum. More investors are recognizing the importance of aligning their values with their financial goals. Expect to see increased funding directed toward projects that have measurable positive impacts.

Regulatory Developments

As ESG investing matures, regulations will continue to evolve. Governments and regulatory bodies may introduce new guidelines to standardize ESG disclosures. This regulatory shift will drive businesses to comply, fostering a more consistent and robust ESG environment.

Broader Asset Classes

The range of asset classes available for ESG investing is expected to expand. While traditional equities have seen strong growth in this area, expect more opportunities in fixed income, real estate, and alternative assets. This diversification will make ESG investing more accessible to a broader audience.

Final Thoughts on ESG Investing

By embracing ESG investing, you contribute to a more sustainable future while enhancing your investment portfolio. The key benefits include supporting ethical practices, promoting environmental sustainability, and potentially achieving better long-term financial returns.

As you navigate the challenges and trends in this growing field, remember to prioritize transparency and research to make informed decisions. Equip yourself with the right tools and knowledge to maximize your impact.

Ready to take action? Share your experiences or explore our other articles on investment strategies to deepen your understanding and continue your journey in responsible investing!

Frequently Asked Questions about ESG Investing

What is ESG investing and how does it work?

ESG investing focuses on environmental, social, and governance factors in investment decisions. It involves evaluating companies based on their sustainability practices and ethical governance, helping investors align their portfolios with their values.

What are the main benefits of ESG investing?

The main benefits include promoting sustainability, potentially achieving better long-term returns, and supporting companies that adhere to ethical practices. ESG investments can lead to a positive environmental impact while also appealing to socially conscious consumers.

How can I start investing in ESG funds?

Begin by defining your investment goals and researching various ESG funds. Look for funds with strong performance, transparency, and a proven track record in sustainability. Consider consulting with a financial advisor for personalized guidance.

What challenges do ESG investors commonly face?

Common challenges include a lack of standardized metrics for measuring ESG performance, concerns about greenwashing, and limited investment options in certain sectors. Staying informed about these issues can help you make better investment decisions.

What tools can assist me in ESG investing?

Several tools can help, such as ESG rating agencies, investment platforms that specialize in sustainable investing, and analytics software that assesses companies’ sustainability performance. These resources can provide valuable insights for your investment strategy.

What is the future of ESG investing?

The future of ESG investing looks promising with increasing demand for transparency, advancements in technology for performance assessment, and regulatory developments that will standardize ESG reporting. Expect continued growth in impact investing and a broader range of asset classes.