AIB’s €500 million green bond for climate action

AIB’s €500 million green bond aims to finance vital environmental projects in Ireland, enhancing sustainability efforts and supporting the transition to renewable energy.

The recent €500 million green bond issuance by AIB marks a significant step forward in climate finance, directly investing in environmental projects. How will this reshape Ireland’s sustainability landscape?

AIB’s commitment to green initiatives and climate action

AIB’s commitment to green initiatives is illustrated through its recent €500 million green bond issuance aimed at funding environmentally friendly projects. This initiative signifies a robust step towards achieving sustainability goals in Ireland, focusing primarily on renewable energy and conservation.

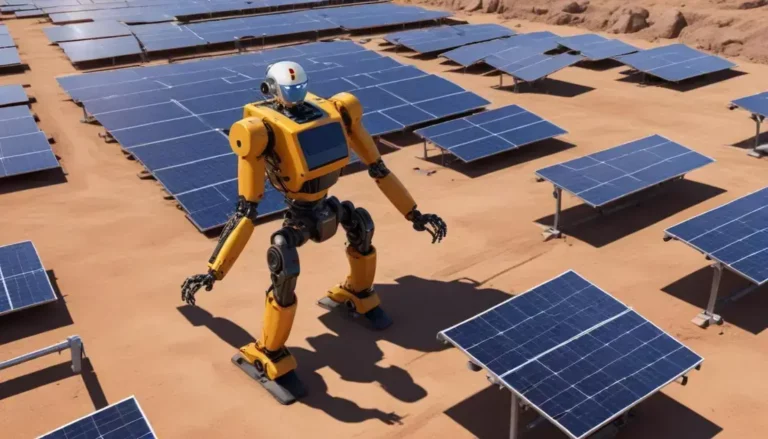

These funds are primarily allocated to projects that optimize energy efficiency and promote the transition towards a low-carbon economy. Through this financial instrument, AIB aims to support advancements in solar power, wind energy, and other sustainable practices, reinforcing its role in combatting climate change.

Moreover, AIB’s strategy aligns with international standards for sustainable finance, making it a pioneer within the banking sector. By investing in projects that adhere to established sustainability guidelines, AIB enhances its reputation while attracting investors interested in ethical financing.

The impact of this green bond extends beyond just financial returns; it creates job opportunities and stimulates local economies. As communities engage with these green projects, they not only benefit financially but also contribute to safety and environmental well-being. The future looks promising, presenting AIB as a leader in climate action and sustainable development.

AIB’s initiative with the €500 million green bond highlights the vital role financial institutions play in promoting sustainability. By investing in projects that enhance renewable energy and reduce carbon footprints, AIB sets an example for others in the industry.

This commitment to green finance not only supports the environment but also helps stimulate the economy by creating jobs and fostering innovation. As we move forward, it is essential for other companies to follow suit, understanding that sustainable practices can lead to long-term success.

By prioritizing climate action, AIB is paving the way for a greener future, encouraging responsible investments that protect our planet for generations to come.

Frequently Asked Questions

What is a green bond?

A green bond is a type of fixed-income instrument specifically designed to support projects that have positive environmental impacts, such as renewable energy and energy efficiency.

How will AIB’s green bond benefit the environment?

AIB’s green bond will finance various sustainable projects, helping to reduce carbon emissions, promote renewable energy, and support initiatives that protect the environment.

Who can invest in green bonds?

Green bonds are open to a range of investors, including individual investors, institutional investors, and banks, all looking to contribute to sustainable development.

What types of projects will be funded by AIB’s green bond?

The projects may include solar and wind energy installations, energy efficiency upgrades, and other initiatives focused on reducing environmental impact.

How does investing in green bonds affect local communities?

Investing in green bonds can create jobs, stimulate local economies, and improve environmental conditions, benefiting communities directly.

Are green bonds a safe investment option?

Green bonds are generally considered safe, especially if issued by established banks like AIB; however, as with all investments, it’s important to assess associated risks.