Discover the top-rated ESG funds for sustainable investing

The best ESG funds prioritize investments in companies that meet strict environmental, social, and governance criteria, offering investors the opportunity to achieve financial returns while positively impacting sustainability and ethical business practices.

Best ESG funds are becoming increasingly popular among investors looking for ethical and sustainable investment options. But how do you choose the right fund that aligns with your values while achieving good financial returns? In this article, we’ll delve into key factors to consider, top-performing funds, and tips for successful ESG investing.

What are ESG funds and why they matter

ESG funds, or Environmental, Social, and Governance funds, are designed to help investors incorporate sustainability into their portfolios. These funds focus on companies that meet specific criteria regarding their impact on the environment, their treatment of employees and communities, and their governance practices. Why are ESG funds important? They provide a way for individuals to align their investments with their values and support companies that prioritize ethical practices.

Understanding ESG Criteria

ESG criteria assess how a corporation manages risks and opportunities related to environmental challenges, social responsibility, and governance issues. For example, an environmentally conscious company might focus on reducing emissions or promoting renewable energy, while a socially responsible one may invest in community programs or ensure fair labor practices.

Popularity of ESG Funds

Over the years, there has been a significant increase in the popularity of ESG funds. Many investors are now looking for more than just financial returns; they are also interested in achieving positive social and environmental impact. This trend indicates a growing awareness of the issues facing our world, driving demand for sustainable investment options.

The Benefits of ESG Investing

Investing in ESG funds can lead to potential long-term financial benefits. Companies that adhere to ESG principles often demonstrate better management practices and can be more resilient in the face of market changes. Additionally, many investors believe that supporting such companies can lead to a more sustainable future.

Challenges with ESG Investing

Despite their many benefits, ESG funds can present challenges such as a lack of standardization in evaluating ESG metrics. Investors should conduct thorough research to ensure they understand how fund managers define and measure ESG criteria. This will help in making informed decisions aligned with their investment goals.

Key features of the best ESG funds

The best ESG funds share several key features that distinguish them from traditional investment options. These characteristics can help investors make informed decisions when selecting funds that align with their values and financial goals.

Environmental Focus

One of the primary attributes of top ESG funds is their commitment to environmental sustainability. They invest in companies that actively work to reduce their carbon footprint, utilize renewable resources, and promote energy efficiency. This focus not only addresses climate change but also positions investors in industries likely to grow as global awareness increases.

Social Responsibility

Effective ESG funds also emphasize social responsibility. This includes investing in companies that prioritize fair labor practices, diversity and inclusion, and community engagement. Such companies often enjoy strong reputations, which can translate into better performance over time.

Strong Governance Practices

Good governance is a critical aspect of successful ESG funds. These funds typically select companies with clear governance structures, ethical practices, and transparency. A strong board of directors and effective management can help ensure a company’s long-term success and sustainability.

Active Management and Screening

Many of the best ESG funds employ active management styles, continuously analyzing and screening potential investments based on ESG criteria. This can help identify companies that will perform well while aligning with ethical investing principles.

Transparency and Reporting

Transparency is essential for ESG funds. Investors should look for funds that provide clear reporting on their ESG criteria and the impact of their investments. Open communication regarding fund performance and changes in strategy can foster trust and accountability.

How to evaluate ESG funds for your portfolio

Evaluating ESG funds for your portfolio involves several important steps to ensure that your investments align with your values and financial goals. Here are some practical tips to guide your evaluation process.

Understand Your Values

Before choosing an ESG fund, it’s essential to clarify what aspects of sustainability are most important to you. Whether it’s environmental impact, social justice, or corporate governance, knowing your priorities can guide your selection process.

Research ESG Ratings

Many companies and organizations provide ESG ratings that evaluate how well funds meet specific sustainability criteria. Check these ratings to see how different funds compare. Reputable sources can offer insights into the performance and practices of the companies within these funds.

Review Fund Composition

Take a closer look at the companies that make up the ESG fund. Identify their practices, sectors, and overall impact. Look for transparency regarding the fund’s holdings and how they align with your ethical investing criteria.

Examine Historical Performance

While past performance does not guarantee future success, reviewing how the fund has performed over time can provide insight into its stability and potential. Compare its performance to benchmark indices to see how it fares against other investment options.

Check Fund Management

The team managing the ESG fund plays a critical role in its performance. Research their experience and track record in ESG investing. Understanding their investment strategy can help you determine if they are the right fit for your portfolio.

Assess Fees and Expenses

Every investment comes with fees. Evaluate the costs associated with investing in the ESG fund, such as management fees and other expenses. Lower fees can mean higher returns, so it’s crucial to consider how fees impact your overall investment.

Top-performing ESG funds in 2023

In 2023, several ESG funds have stood out for their strong performance and commitment to sustainable investing. These funds not only provide financial returns but also contribute positively to environmental and social goals.

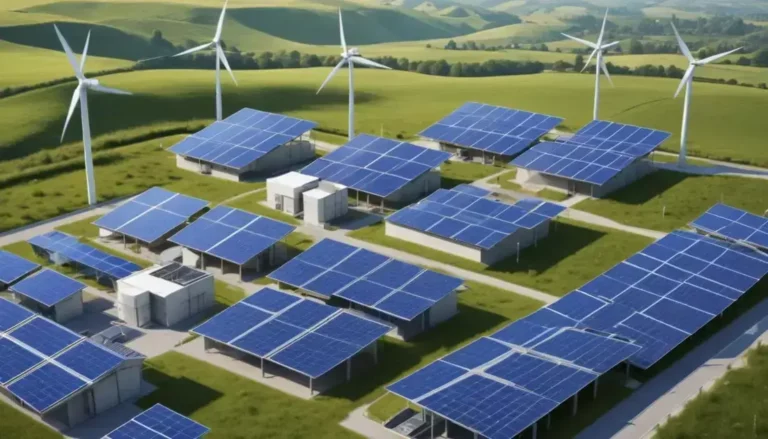

Fund A: Commitment to Renewable Energy

One of the top ESG funds is Fund A, which focuses on investing in companies involved in renewable energy solutions. With a portfolio that includes solar, wind, and energy storage companies, Fund A aims to capitalize on the growing demand for clean energy.

Fund B: Social Impact Focus

Fund B has received attention for its investments in organizations that prioritize social impact. By targeting companies that promote diversity and community development, this fund enables investors to support businesses making a difference while still achieving solid financial returns.

Fund C: Strong Governance and Stability

Another standout is Fund C, recognized for its rigorous governance criteria. This fund invests in companies with strong management practices and ethical guidelines, leading to greater accountability and stability. Its historical performance has made it a reliable choice for ESG investors.

Fund D: Innovation in Technology

Fund D emphasizes technological innovation as a key driver of sustainable growth. By investing in tech firms committed to environmental sustainability, this fund offers investors a chance to benefit from advancements in green technologies.

Fund E: Holistic ESG Approach

Fund E adopts a holistic approach by integrating environmental, social, and governance factors into its investment strategy. This diversified fund aims for balanced exposure across multiple sectors, enhancing its growth potential while promoting responsible practices.

Common misconceptions about ESG investing

Despite its growing popularity, ESG investing is often misunderstood. Here are some common misconceptions that can deter investors from exploring this responsible investment strategy.

ESG Investing is Just a Trend

Many people believe ESG investing is a passing fad, but it has become a vital part of the investment landscape. Investors are increasingly aware of environmental and social issues, making ESG a fundamental aspect of future investment strategies.

ESG Funds Underperform Financially

There is a belief that ESG funds do not perform as well as traditional investments. However, numerous studies have shown that ESG funds can match or exceed the returns of their non-ESG counterparts. Companies focused on sustainability often show resilience and long-term growth potential.

ESG Investing is Only for Large Investors

Another myth is that only wealthy investors can access ESG investments. In reality, there are a variety of ESG funds available for all types of investors, including those with smaller investments. Many platforms now offer options for individuals to invest in ESG-focused portfolios.

All ESG Funds are the Same

Some think that all ESG funds have the same criteria and focus. However, ESG funds can vary significantly in their approach to sustainability. It is essential to research specific funds to understand their focus areas, performance, and management practices.

Investing in ESG Means Sacrificing Returns

Many fear that in pursuing ESG investments, they may have to sacrifice financial returns. This is not true. By aligning their investments with sustainable practices, investors can achieve competitive returns while also contributing to positive change in the world.

Future trends in ESG fund management

The landscape of ESG fund management is evolving rapidly. As investors become more conscious of their impact, several future trends are emerging that could shape the way ESG funds are managed.

Increased Regulatory Scrutiny

In the coming years, regulatory bodies are expected to impose stricter guidelines on ESG disclosures. This means funds will need to be transparent about their investment practices and the sustainability of their portfolios. Investors will demand accountability, leading to enhanced reporting standards.

Focus on Impact Measurement

Fund managers will likely prioritize measuring the actual impact of their investments on environmental and social issues. Instead of focusing solely on financial returns, there will be a greater emphasis on metrics that gauge positive contributions to society and the planet.

Integration of Technology

Technological advancements will play a crucial role in ESG fund management. Tools like artificial intelligence and big data analytics will help fund managers analyze ESG factors more effectively and provide deeper insights into potential investments. This can lead to more informed decision-making.

Shift Towards Sustainable Practices

There will be a continued shift towards supporting companies that adopt sustainable business practices. ESG funds will increasingly favor organizations that prioritize renewable resources, waste reduction, and corporate social responsibility. This trend reflects a general societal movement towards sustainability.

Engagement and Stewardship

Fund managers are expected to take more active roles in engaging with the companies they invest in. This includes advocating for better corporate governance and sustainable practices. Active stewardship can drive change and encourage companies to operate more responsibly.

Understanding ESG Funds for a Better Future

As we have explored, ESG funds are more than just a trend; they represent a shift towards responsible investing that aligns financial goals with personal values.

Investors can drive positive change by choosing funds that focus on environmental sustainability, social responsibility, and strong governance. With increased transparency, better measurement of impacts, and the integration of technology, the future of ESG fund management looks promising.

By staying informed about these trends and understanding how to evaluate and choose the best ESG funds, you can play an active role in supporting a more sustainable future. Remember, every investment decision is a chance to contribute to a better world.

Frequently Asked Questions

What are ESG funds?

ESG funds are investment funds that prioritize companies based on environmental, social, and governance criteria, aiming for sustainable and ethical investing.

How can I evaluate ESG funds for my portfolio?

To evaluate ESG funds, consider their investment focus, performance history, fees, and the transparency of their management.

Are ESG funds more expensive than traditional funds?

Some ESG funds may have higher fees due to increased research and management efforts; however, many offer competitive costs.

Do ESG investments sacrifice financial returns?

No, studies show that ESG funds can perform equally well or better than traditional funds, benefiting both the investor and society.

What impact do ESG funds have on companies?

Investing in ESG funds encourages companies to adopt sustainable practices, improve governance, and act responsibly, leading to overall positive changes.

How can I stay updated on ESG investing trends?

You can stay informed by following financial news, subscribing to investment newsletters, and participating in online forums focused on sustainable investing.